ReceivablesPro supports USB Card readers as an entry mechanism for credit card transactions. Instead of selecting a customer and then typing card number and expiration date into the system, you can just swipe.

Additionally, the ReceivablesPro Mobile App uses a proprietary secured card reader that enables you to process swiped transactions on your iPhone, iPod or iPad. (See Appendix F: ReceivablesPro Mobile for detailed information about the Mobile App.)

You can use the swipe function whether or not your credit card merchant account is configured for Retail (card present) transactions.

If your processing account is configured for Retail, track data from the credit card’s magnetic strip will be submitted for authorization and the swiped transaction will be processed as a card-present Retail transaction.

If your account is not configured for Retail, all transactions entered using a swiped card will be entered as MOTO, and track data will never be transmitted. The system will simply extract name, card number, and expiration date from the track data, use it to generate the transaction, and store it as if you had manually entered it.

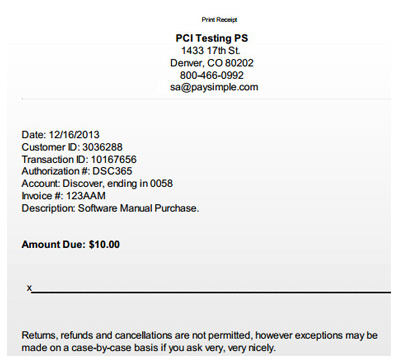

Authorizing swiped credit card transactions is done by having your customer sign a receipt for the transaction. In the Mobile App, a signature screen is provided and your customer’s signature is digitally stored with the Transaction Details record. When using a USB swiper with the web -based UI, you must print a paper receipt for your customer to sign. This receipt contains the following key elements that are required by payment processing rules:

Your Company Name and Contact information. (As you set them in the Settings-->Configuration--> Preferences screen. See Invoice Preferences in Chapter 8.)

The Payment Date.

The Transaction Amount

The Transaction ID and Authorization number.

The credit card type and last four digits of the card number.

A description of the products and/or services to which the payment applies. This is the text you enter in the Payment description field on the Collect Payment form.

NOTE: The Payment description field is not required, and the system will permit you to process a transaction if you leave it blank. However, a description of the goods/services sold MUST be included on the signed payment receipt in order to properly authorize a swiped card-present transaction.

A line for your customer to sign.

Your complete terms and conditions of sale. These must include your return policy, and any other terms related to the sale. A default Terms line is included by default. You should review and edit this for your company prior to processing swiped transactions. Changes to the Swipe Terms of Sale are made in the Settings-->Configuration-->Swiped Terms of Sale screen. (See Swiped Transaction Settings in Chapter 8.)

A sample of the Receipt screen follows:

Once your Customer signs the receipt, be sure to give them a copy of the signed page (or print two copies and give one to the Customer.). You should also store the signed receipts in a secure location. You can store the signed pieces of paper themselves. Or, you can scan the receipts and store them in an encrypted file or on an encrypted removable media drive (such as a USB Flash Drive). You may need to produce these receipts in the case of a Chargeback (see Credit Card Chargebacks for more information on chargebacks.), so it is important that you keep them for at least 18 months from the transaction date, which is the maximum time allowed for a chargeback to be initiated. (In many cases the window is shorter.)

If you do not have a true Retail credit card merchant account, you will be using the swiper as an entry mechanism to authorize MOTO (card-not-present) transactions. Since these transaction will not submit track data from the card as part of the authorization process, it is doubly important that you obtain a signature from your customer. The signature on the receipt page will serve as your written authorization to process the transaction, which meets the requirements for processing a MOTO transaction.